Table Of Content

Interest rates tend to change daily, and sometimes rates even change during the day. You can compare current mortgage rates from our partner lenders here. You will get an idea of the interest rate, APR, closing costs, and monthly payment, but you should bear in mind that these numbers will change depending on your credit score and other financial details. The first thing borrowers need to think about is what type of product they want. One is a fixed-rate amortizing loan, such as the common 30-year amortizing mortgage. The other is an adjustable rate mortgage (ARM) where the rate can fluctuate over time.

Today's national 30-year mortgage interest rate trends

You might qualify for the best current mortgage rate if you can make a 20% (or larger) down payment. That's because making a bigger down payment reduces your loan-to-value ratio, which lowers the risk for the lender, which in turn could qualify you for a lower rate. Paying attention to your mortgage rate could help you shave thousands of dollars -- or even tens of thousands -- off the total cost of your loan.

How to refinance your current mortgage

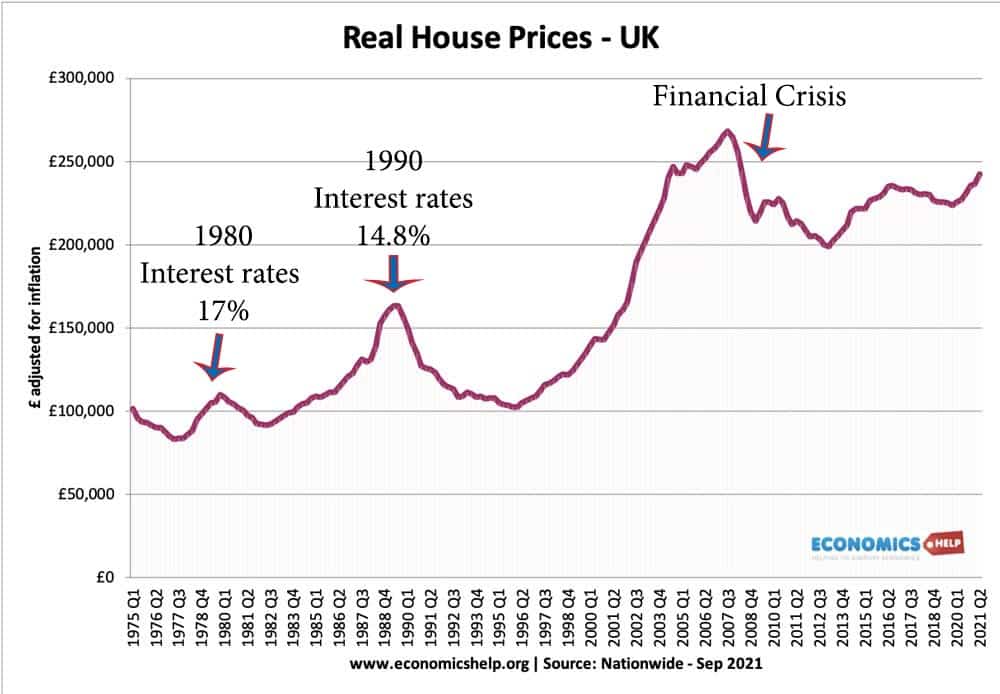

Mortgage rates are indirectly influenced by the Federal Reserve’s monetary policy. When the central bank raises the federal funds target rate, as it did throughout 2022 and 2023, that has a knock-on effect by causing short-term interest rates to go up. In turn, interest rates for home loans tend to increase as lenders pass on the higher borrowing costs to consumers. Buying a house is costlier than anytime in at least the last decade, with property buyers hit with the double whammy of rising mortgage rates and home prices, according to real estate company Redfin. “Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates,” Kushi said.

Personalized versus average interest rates

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. Refinancing at lower rates is always a good idea as long as the homeowner plans on staying in the home long enough to justify the closing costs of the loan. If the current rate is significantly lower than the original, the homeowner might consider shortening the new loan’s maturity.

Bankrate has reviewed and partners with these lenders, and the two lenders shown first have the highest combined Bankrate Score and customer ratings. You can use the drop downs to explore beyond these lenders and find the best option for you. Lenders call it “risk-based pricing.” A higher credit score indicates a lower risk that you’ll default on a loan — so you get a better interest rate.

If you're having trouble getting a good rate, you might want to work on improving your credit or saving for a larger down payment and reapply later. You should also be careful about overspending in a low rate environment. Though you may be able to borrow a larger amount with a low rate, make sure you aren't stretching your budget too far. You don't necessarily need to borrow the full amount the mortgage lender approves you for. Mortgage refinance rates typically differ somewhat from purchase rates, and may be slightly higher — particularly if you're getting a cash-out refinance, since these are considered riskier. Most major forecasts expect rates to start dropping throughout the next few years, and they could ultimately end up somewhere in the 5% range.

Throughout 2020, the average mortgage rate fell drastically due to the economic impact of the COVID-19 pandemic. Thirty-year fixed mortgage rates hit a historic low of 2.65% in January 2021, according to Freddie Mac. Sky high mortgage rates have pushed many hopeful buyers out of the market, slowing homebuying demand and putting downward pressure on home prices. The current supply of homes is also historically low, which will likely push prices up.

Compare today’s mortgage interest rates – April 25, 2024 - CNN Underscored

Compare today’s mortgage interest rates – April 25, 2024.

Posted: Thu, 25 Apr 2024 12:25:06 GMT [source]

They often include points that lower your mortgage interest rate but increase your upfront fees. Unless you have great credit, a significant down payment, and don’t mind paying extra closing costs, you probably won’t get those advertised rates. Many homeowners have taken the opportunity to refinance in this low rate environment, and it isn't too late to do so. For whatever reason, borrowers sometimes choose not to refinance when it is in their best interest to do so. So, homeowners should definitely take the time to compare their existing mortgage rate and see if they can do better. A 30-year fixed-rate mortgage is by far the most popular home loan type, and for good reason.

Jumbo mortgage interest rate moves up, +0.17%

Fannie Mae's latest forecast predicts that 30-year rates will fall to 6.4% by the end of the year. The Mortgage Bankers Association believes rates could drop to 6.1%. Mortgage rates are expected to trend down eventually, but they likely won't recede until inflation decelerates further.

Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Our editorial team does not receive direct compensation from advertisers. We are pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the Nation. You really have to do your research if you want to get the best mortgage rate. Total finance charges may be higher over the life of the loan • We arrange loans with third party providers.

The answer will represent the number of months it will take to get your money back from refinancing, also called the breakeven point. Therefore, if you plan to live in your home longer than the answer to this math problem, you should refinance. If you plan to live for fewer months, then you should not refinance. Monetary policy is one of the most important drivers of mortgage rates. In particular, following the Great Recession, in economic downturns, the Federal Reserve has been aggressively trying to influence long-term rates in the economy through quantitative easing (QE).

The best mortgage rate for you will depend on your financial situation. The standard 30-year fixed rate mortgage is benchmarked off the 10-year U.S. The spread reflects the "cost" of the mortgage to an investor based on the risks that the borrower could prepay their loan down the road or default on the loan in the future. These costs rise and fall with general economic conditions, including the prevailing interest rate environment causing rates to rise and fall according to changes in the risk of these loans to investors. Market demand and supply forces are drivers of mortgage rates, as well. Because mortgage lenders tend to base their advertised rates on ‘ideal’ borrowers.

No comments:

Post a Comment